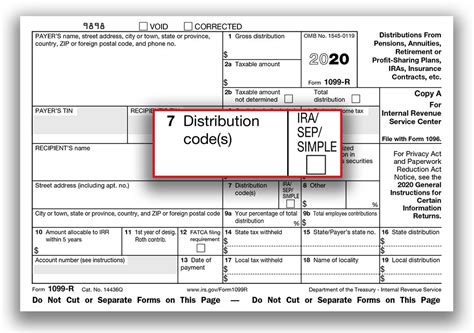

box 1 gross distribution The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, . Threadforming Screws for Metal. DIN7500 Tap-Fix® extruded; DIN7500 Tap-Fix® hole sizes; DIN7500 Tap-Fix® torsional; View all articles

0 · distribution code 9 irs

1 · box 7 distribution code

2 · 1099 r gross distribution

To flip the last junction box, you need to solve a quick puzzle to open the door. Simply flip the right-hand box, then the one to the left of it - so number 4 and number 3 in the row.

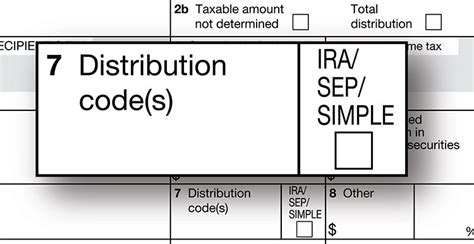

For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.File Form 1099-R for each person to whom you have made a designated distribution . I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check .

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a . The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is . Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may .

5: Employee Contributions This amount is the difference between Box 1 “Gross Distribution” and Box 2a “Taxable Amount.” This amount equals the employee contributions recovered tax free .

distribution code 9 irs

Box 1: The gross distribution is the total amount you received from your WRS account. This amount may have been received as monthly payments, a lump-sum payment or as a rollover. .Box 1: This box will be pre-filled with the gross (total) distribution amount you’ve received; Box 2a: This will show your total taxable amount based on your distribution. A “0” indicates that your distribution was: a qualifying direct .For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7. I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check (,000). The amount reported in box 1, is the amount with the 20% tax I already paid (,250).

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

box 7 distribution code

The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This .Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may have received this amount in a number of different ways, including: A direct rollover; A transfer or conversion to a Roth IRA; A recharacterized Roth RIA contribution5: Employee Contributions This amount is the difference between Box 1 “Gross Distribution” and Box 2a “Taxable Amount.” This amount equals the employee contributions recovered tax free during year. (See Explanation for Box 9b for further information on what is considered “tax free”)

Box 1: The gross distribution is the total amount you received from your WRS account. This amount may have been received as monthly payments, a lump-sum payment or as a rollover. Box 2a: The taxable amount on the distribution from your WRS account. There is an amount reflected in Box 5 (Employee contributions), which is non-taxable.Box 1: This box will be pre-filled with the gross (total) distribution amount you’ve received; Box 2a: This will show your total taxable amount based on your distribution. A “0” indicates that your distribution was: a qualifying direct rollover (from a qualified plan to another or to a traditional IRA, or a direct rollover from a Roth .For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.

sheet metal bracket design

I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check (,000). The amount reported in box 1, is the amount with the 20% tax I already paid (,250). Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This .Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may have received this amount in a number of different ways, including: A direct rollover; A transfer or conversion to a Roth IRA; A recharacterized Roth RIA contribution5: Employee Contributions This amount is the difference between Box 1 “Gross Distribution” and Box 2a “Taxable Amount.” This amount equals the employee contributions recovered tax free during year. (See Explanation for Box 9b for further information on what is considered “tax free”)Box 1: The gross distribution is the total amount you received from your WRS account. This amount may have been received as monthly payments, a lump-sum payment or as a rollover. Box 2a: The taxable amount on the distribution from your WRS account. There is an amount reflected in Box 5 (Employee contributions), which is non-taxable.

sheet metal blanking force calculation

1099 r gross distribution

Westerheide Sheet Metal Co Stainless Steel Workers 2034 Saint Clair Ave, St Louis, St Louis, MO, 63144-1614 ( Show me directions ) Show Map

box 1 gross distribution|distribution code 9 irs