metal fabrication machinery tax incentives One of the most compelling reasons to invest in a CNC motorized folder now is the opportunity to leverage Section 179 tax deductions. This provision allows businesses to deduct the full . An aluminum boat seat box base is a storage unit that doubles as a seat for your fishing boat. It is typically made from high-quality aluminum material that is lightweight yet durable enough to withstand harsh marine environments.

0 · Using Section 179 Tax Incentives for Heavy Metal Manufacturing

1 · Tax benefits boost incentives for year

2 · Tax Legislation, Incentives and Section 179 Deductions

3 · Section 179 Tax Incentive: A Game

4 · Maximize Tax Savings: Invest $2.7M in Metal Fabrication with

5 · Maximize Savings: Section 179 on Robotic Plasma Machines

6 · Manufacturing Equipment Tax Incentive: 2023 Rules for Section

7 · Invest in a CNC Folder: Tax Savings & Tariff Shield

8 · Driving Business Growth: Harnessing Section 179 Tax

1 talking about this

factory cnc machine

One of the most compelling reasons to invest in a CNC motorized folder now is the opportunity to leverage Section 179 tax deductions. This provision allows businesses to deduct the full .By utilizing Section 179, businesses can significantly offset the initial cost of these machines. This tax incentive makes it feasible for smaller operations to access advanced technology that was .

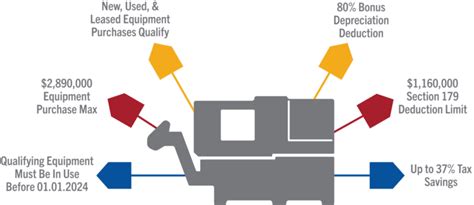

Discover how the Section 179 tax incentive can significantly benefit your sheet metal machinery investments and why to take advantage of it before the year ends.Investing in metal fabrication equipment is a significant decision, and with the Section 179 deduction, you can invest up to ,700,000 in new or used machinery. This high deduction .The Section 179 tax deduction allows companies to write-off up to ,080,000 of equipment if total acquisitions are less than ,700,000. If capital acquisitions exceed ,700,000, this write-off . Instead of depreciating the cost of qualifying assets over several years, Section 179 allows you to deduct the full purchase price in the year the asset is placed in service. This immediate tax benefit can provide a substantial .

fallout 4 metal box

Full taxpayers in need of the sheltering effect of equipment depreciation typically benefit from tax ownership of equipment. This can be accomplished with a loan, installment payment agreement, and some leases. For businesses doing heavy metal manufacturing, Section 179 allows you to deduct the full purchase price of qualifying machines and equipment that is purchased or . Changes in tax legislation, including deductions for equipment purchases or investment credits, can significantly affect a company's decision to invest in new metal . When businesses are able to lower their taxable income through deductions, or directly reduce their tax liability through credits, the cost of investing in new equipment becomes more manageable .

In the ever-evolving world of metal fabrication, staying ahead of the curve is crucial for maintaining efficiency and profitability. One of the most effective ways to achieve this is by leveraging tax incentives like Section 179, which allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year.Jun 25, 2019 - The Section 179 tax incentives have been increased to a ,500,000 spending cap & a ,000,000 write-off! The 50% Bonus Depreciation has also been increased to 100%. Let the government help buy your new machinery this year! #Metalwork #Fabrication #Automation #Machinery #Business

Metal fabrication companies may be eligible for R&D tax credits for performing qualified research activities. For example, the following activities may be eligible for R&D tax credits: Performing technical research on alternative metals and chemical compounds to improve product(s) or .Tax Incentives. We’ve already discussed how eco-friendly practices can lower production costs. However, you probably didn’t know there are tax incentives for companies trying to be more sustainable. . Parts For Metal Fabrication Machinery; Givi Press Brake Scales; Metal Roofing Machinery For The Roofing Industry; About Toggle child menu .Sheet Metal Software HacoBend2d is a software module used for creating simple 2D-profiles for production on a press brake. It is quick and easy to use thanks to the clear and simple user-interface.Understanding Section 179 and Its Benefits for Businesses. Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This means that if you buy or lease a piece of qualifying equipment, you can deduct the full purchase price from your gross income.

Invest .7M in Metal Fabrication Equipment. Investing in metal fabrication equipment is a significant decision, and with the Section 179 deduction, you can invest up to ,700,000 in new or used machinery. This high deduction limit means that even substantial investments in high-quality equipment are eligible for a full or partial deduction . As a business owner, navigating the complexities of tax codes can be daunting. However, there's one provision that could significantly benefit your bottom line: Section 179 of the Internal Revenue Code. This tax break allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year.

As the President of Mac-Tech, I’ve dedicated my career to helping manufacturers navigate the complexities of machinery upgrades.With over 40 years in the business, I’ve seen firsthand how strategic investments in technology can transform operations. My focus is on automation and precision fabrication, where the right equipment can significantly enhance efficiency and .

The second part of our 2024 Elections series dives into tax legislation, incentives for metal fabrication companies and section 179 deductions (IMPORTANT FOR THOSE LOOKING FOR MACHINERY NOW!)unemployment occurring when jobs are replaced because of advances in technology, such as machinery replacing manual labor. structural unemployment. some kind of benefit, often in the form of tax breaks, given by the government to encourage a type of behavior, such as tax incentives to increase exports.CNC Hydraulic; Electric Press Brakes; Tandem Press Brakes; Press Brake Automation; Press Brake Tooling; Fiber LasersIn this next installment, we look at investment tax credits and how they can benefit you for 2024 for purchase of new or used equipment. Stay tuned, follow.

Manufacturing companies should take advantage of U.S. Federal Tax Incentives to reduce equipment costs. This deduction allows a company to deduct the first. Toll Free: 800-822-8152 | Phone: 425-513-8263 | Fax: 425-513-8264 | Email: [email protected]. . Filed Under: Metal Fabricating Equipment & Machines.Since we are not developing or designing an end product, does advancing or the metal fabrication product/process qualify for the R&D Tax credit? Yes, metal fabrication can qualify for the R&D Tax and it can apply to taxpayers who are .Exemptions are available for: Machinery or equipment used directly in manufacturing, see A.R.S. § 42-5159(B)(1).; Machinery, equipment or transmission lines used directly in producing or transmitting electrical power, but not including distribution, see A.R.S. § 42-5159(B)(4).; Machinery or equipment used in research and development, see A.R.S. § 42-5159(B)(15).

As demand for sustainable building materials grows, metal construction is becoming increasingly vital. Metal roofs and siding not only offer eco-friendly benefits but also qualify for tax rebates and LEED credits, making them a cost-effective choice. In this third part of our series, we'll explore how metal roofing contributes to environmental conservation and financial savings through tax .In the ever-evolving landscape of metal fabrication, making strategic investments in equipment can significantly impact your bottom line. Plate rolls, essential for bending and shaping metal plates, are one such investment that can offer substantial returns.Leveraging tax benefits under Section 179 and taking advantage of sale prices can further enhance the return on investment .

The Section 179 tax incentive is a game-changer for businesses investing in sheet metal machinery. It allows businesses to deduct the full purchase price of qualifying equipment from their gross income, meaning that instead of depreciating the equipment over several years, businesses can deduct the full cost upfront, providing a significant tax benefit.Stone + Metal Fabricators can take advantage of huge tax savings in purchasing machinery for 2020 with Section 179. Includes Bonus Depreciation, Deduction info and more! . and supporting machinery for stone fabricators. Since 1953. Browse All . TAX INCENTIVES. Explore the financing options and 2024 tax incentives available. Maximizing savings on metal fabrication software through Section 179 is a strategic move that can significantly enhance your business’s efficiency and profitability. By understanding and leveraging this tax incentive, you can make high-quality software solutions more affordable, positioning your business for long-term success.

List Your Machine It's free; Tax Incentives You didn't know aboutThe metalworking industry, much like its counterparts in other manufacturing sectors, stands in a prime position to qualify for the R&D tax credit.Despite the misconception that daily operations in metal fabrication may not be categorized as research and development, the tax definition of R&D is expansive, encapsulating many of these routine activities.

Using Section 179 Tax Incentives for Heavy Metal Manufacturing

Furthermore, businesses should explore supplementary tax incentives and credits that complement Section 179, such as bonus depreciation and state-level deductions. A careful review and understanding of these tax strategies empowers businesses to mitigate overall tax burdens and cultivate a robust financial landscape. When businesses are able to lower their taxable income through deductions, or directly reduce their tax liability through credits, the cost of investing in new equipment becomes more manageable . Metal fabrication companies need to stay informed about political and economic trends to navigate post-election changes effectively. This involves planning for potential policy shifts, adapting to .

Tax benefits boost incentives for year

Tax Legislation, Incentives and Section 179 Deductions

Though they can have other functions, tie rods and anchor plates used to connect exterior walls to internal floor and roof beams generally follow a horizontal line on building facades. This can look haphazard in some cases but can also be planned to fit into a design, assuming a builder is on board and it fits the budget.

metal fabrication machinery tax incentives|Driving Business Growth: Harnessing Section 179 Tax