what does distribution code 1d meean in box 7 Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life . Buy First Aid Medicine Box Supplies Kit Organizer - 8.6" White Metal Tin Medic Bin Hard Case with Removable Tray Handle Storage Compartment, Vintage Antique Empty Boxes for Home Family Emergency Tool Set at Walmart.com

0 · box 7 rollover codes

1 · box 7 r code

2 · box 7 ira contribution codes

3 · 457 b distribution code

4 · 1099 r box 7 distribution

$51.99

box 7 rollover codes

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .The code (s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

box 7 r code

Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .

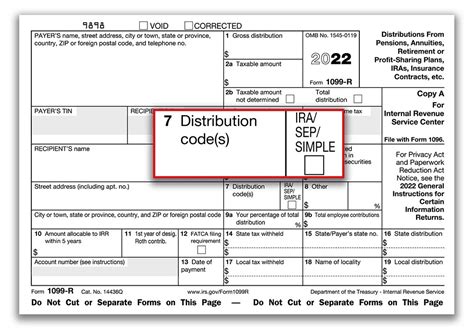

Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.

To report your loan that is treated as a deemed distribution into the program, please follow the pathway below and enter Code L plus Code 1 or Code B, (whichever is applicable) in box 7. . You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

box 7 ira contribution codes

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . What does Distribution Code T mean in box 7 of form 1099-R? It means a Roth IRA distribution, not subject to a early distribution penalty because the IRA owner is over age 59 1/2, disabled or died, but the payer does no know if the 5 year . Did you mean: US En . United States . You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. View solution in original post June 3, 2019 12:55 PM.The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code . If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. .

Code D1 indicates a distribution from a nonqualified annuity or life insurance contract and the taxable amount of the distribution is subject to an early-distribution penalty. Codes D and 1 together are correct if the contract is considered to be a . The X between boxes 7 and 8 is not the box 7 code. The box 7 code is a letter (other than X) or an number, or a combination of two letters/numbers. When the box 7 code is 7, some people get confused and do not recognized that 7 is the code. Code 7 means that the distribution was made after reaching age 59½. Codes J and 8 together is correct coding to indicate a return of contribution from a Roth IRA. This is a special-case use of code J to indicate that the return of contribution was from a Roth IRA and is to be used with code 8 (or P) for any return of contribution from a Roth IRA before the due date of the tax return, even when the distribution occurred after you reached age 59½.

Using Turbotax Desktop, Feb 23 2022 update, entering 1099-R for an inherited IRA (from 2018 so using 10 year withdrawal plan). 1099-R entered exactly as printed on 1099-R: boxes #1, 2a, 2b (Taxable amount not determined), #4 0.00 -- results in, initially a 28% tax, but after entering code 4 in box 7, and checking of the IRA/SEP/SIMPLE box, all taxes go to "0".

How was Box 7 of your Form 1099-R coded? You should enter each Form 1099-R exactly as shown. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.However, any interest you receive is taxable and you should report it as interest received.

Did you mean: US En . United States . They then need to issue a correct original code G Form 1099-R for this distribution to the obviously alive participant. If they refuse, you'll need to enter a substitute code G Form 1099-R and provide explanation. . My 1099r has code 4g in box 7 and it should only be a g I have tried getting a corrected . The code D in box 7 is a new code this year for section 1411. Her 1099R has box 1 gross distribution 27,000 box 2 7,000, box 5 34,000 box 7 code 7D. . I think it is ordinary distribution (code 7) the D may be because the issuer thinks that the recipient has income over the threshold. A call to the annuity company or issuer of 1099-R is . The code D indicates that the distribution is not from an IRA or any other kind of qualified retirement account.. As VolvoGirl indicated, the question that you are being asked is only to determine which subsequent questions to ask, if any. You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue.

For tax years beginning on or after January 1, 2005, any amounts reported in gross income for Federal Income Tax purposes for a retirement annuity that is not an employer sponsored retirement annuity (reported as Codes 1D, 2D, 3D, 4D or 7D in Box 7 beginning with 2013 Forms 1099-R) are reported as interest income on PA Schedule A regardless of . This distribution will appear of Form 1040 lines 5a and 5b as a pension or annuity. Any Form 1099-R that is not from an a traditional IRA (IRA/SEP/SIMPLE box marked) or a Roth IRA (code J, T or Q in box 7) is reported as pension or annuity income. In this case, the code B indicates that this Roth account is not a Roth IRA.

In 2023 I received a 1099-R form from the broker with a gross distribution (Box 1) of 90 and a taxable amount (Box 2A) of 0. Box 7 (distribution code) says "PJ". The 1099-R form has a year of "2022" and *not* "2021" which to me suggests that it goes into the 2022 return. I entered this form into Turbotax, with the 0 gain (form says 2022). My understanding is that if the distribution code on the 1099-R form is 7D, it means that the income is taxable in PA. . (reported as Codes 1D, 2D, 3D, 4D or 7D in Box 7 beginning with 2013 Forms 1099-R) are reported as . Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7. 15 Tax Calculators . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . My client is a 85 year old man who received a 1099R with the code 1D in box 7. The return is assessing this gentleman a 10% penalty because of this code. He obviously is over the age of 59 1/2. . Code 12 Exceptions • Distribution on or after the date the participant turned age 59½ if box 7, Form 1099-R, incorrectly indicates it is an early .

the 10 best metal fabricators in illinois

The box 7 code was "J". The removal of excess paperwork was submitted with the T D Ameritrade calculates earnings option selected. . code J is always present to indicate that the distribution is from a Roth IRA and does not necessarily mean that the distribution was an early distribution. If you were over age 59½ at the time of the .

Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject to an early withdrawal penalty. Box 7 Distribution Codes: 1 – Early distribution (except . The loan was satisfied by the offset distribution being reported with code M. Because an offset distribution is eligible for rollover, you can get the money back into a retirement account by rolling over (usually to a traditional IRA) some or all of the gross amount of the offset distribution by the due date of your 2018 tax return, including extensions.

In Box 7 on my 1099R I have the code E what does it mean? US En . United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX; Expert does your taxes. . What does Distribution Code E mean in box 7. Code E box 7 means "Distributions under Employee Plans Compliance Resolution System (EPCRS)." This would be to .

457 b distribution code

Code F is not for a distribution paid directly to charity. Code F indicates a payment to YOU from a charitable gift annuity. A charitable gift annuity is not an IRA. You are not permitted to change the code from what the payer provided on the Form 1099-R. Does the Form 1099-R provided to you by the payer have code F in box 7? I suspect not. I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution From? Select the Source of this Distribution. I select "None of the above" because it is .

1099 r box 7 distribution

The code in Box 7 of your 1099-R helps identify the type of distribution you received. When the code is used to determine if your distribution is taxable or subject to an early withdrawal penalty. A distribution of code 3 in box 7 of your form 1099R means that you took a distribution due to a disability. Some reporting agencies put a qualifying explanation with a second code in box 7b when box 7(a) code is 2. This is because a box 2 code is that you don't have a penalty for the early distribution, but that box doesn't say why. Box 7b does give the explanation with a code. But it is not required for the issuing agency to put this information.

in box 2a seems wrong unless the Form 1099-R has an amount in box 5 equal to the amount in box 1, which seems really unlikely. Is box 2b Taxable amount not determined marked? The deadline for completing the rollover of a qualified offset distribution is the due of your tax return, including extensions.

Then go through X-rays and metal detectors. Then a dog sniffs you and you can head in. We apparently got “lucky” and they were testing out new VIP tour guides.

what does distribution code 1d meean in box 7|457 b distribution code