industrial manufacturing metal fabrication equipment depreciation schedule What is MACRS depreciation? MACRS stands for Modified Accelerated Cost Recovery System – is the tax depreciation system used to calculate your the depreciation of your tangible . $24.29

0 · tax depreciation for property use

1 · tax depreciation for personal use

2 · tax depreciation for business use

3 · qualified improvement property depreciation

4 · ireland section 179 depreciation

5 · ire 704 depreciation

6 · depreciation of property in service

7 · accelerated cost recovery depreciation

To start using it, simply add your preferred mattress on top and decorate with bright .

The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 (a) of the IRC or the alternative depreciation system provided in . Machinery and Equipment: Often depreciated over 5 to 15 years, depending on the type of equipment and its use. Office Furniture and Fixtures : Usually have a useful life of 7 to .Stay up-to-date with industry trends, market conditions, and technological advancements to make informed decisions regarding CNC machine depreciation rates and ensure long-term success .What is MACRS depreciation? MACRS stands for Modified Accelerated Cost Recovery System – is the tax depreciation system used to calculate your the depreciation of your tangible .

To calculate and determine the useful life of equipment, organizations need to consider various factors and common standards such as the equipment’s operational . In this blog post, we will delve into the types of equipment manufacturing businesses typically purchase, the duration of depreciation, and the intricacies of bonus .

Section 179 allows you to depreciate your equipment 100% this year instead of over 5 years. You also get to write off the interest expense for the next 5 years. You can use the finance .There are several factors that play an important role in determining the depreciable life of your equipment. These include: Industry standards: Depending on the industry you operate in, .

An asset depreciation schedule can be useful in the machinery and equipment valuation process; however, it is generally not reliable on its own. Machine maintenance in metal fabrication can be the difference between profit and loss. Here are 7 tips for reducing machine maintenance costs. . or replacements of metal fabrication machinery. Regular inspections and .Precision. Durability. Performance. Broadwind Heavy Fabrications delivers at a large scale in even the most punishing environments. From sourcing and Design for Manufacturing to fabrication, industrial coating, paint and assembly, we’ll be your single source for industrial metal fabrication with the precision and reliability your customers depend on.

Download Equipment Inventory and Depreciation Schedule Template. Excel | Google Sheets | Smartsheet. Office Equipment Maintenance Schedule Template. Schedule maintenance for your office-specific equipment . To maintain a smooth workflow within a metalworking shop, you must perfect three key factors: equipment, employees, and processes. Embrace lean manufacturing principles to increase metal fabrication productivity; An overall framework for an improved manufacturing process and metal fabrication productivity is known as Lean Manufacturing. This .Write off up to ,000,000 of Equipment costs; Tax Deductions for up to ,000,000 in Equipment; Section 179 allows you to depreciate your equipment 100% this year instead of over 5 years; You also get to write off the interest expense for the next 5 years; You can use the finance company’s money, preserve yours and still gain all the tax .

Since 1989, Industrial Equipment Fabricators, Inc. has been building products for O.E.M's, specializing in custom metal fabricating, design and certified welding. From simple brackets to complex equipment and ASME Pressure Vessels, we have developed a reputation as a premier supplier to companies representing numerous industries.By definition, the companies involved in metal fabrication in Mexico are engaged in the use of products obtained from metallurgical processes for the production of items such as metal parts and finished products, industrial tools and machinery and equipment for industries such as HVAC

SWF Industrial produces quantities of hundreds to thousands of tight-tolerance parts to our customers' exacting standards every day. We have the expertise in custom stainless steel, carbon steel, and all metal fabrication to create what you need from any metal – galvanized, aluminum sheet metal, or stainless steel and carbon steel sheet metal.

As per schedule XIV of Companies act, 1956, depreciation rates has been provided for Straight line Method as well as Written down Value. The Act also provides for charging the fixed assets below monetary limits. The depreciation is charged as per rates provided in the schedule irrespective of whether asset is scrapped, discarded etc.Is specialized for metal fabrication. Serves the needs of over 2,000 fabricators globally. Supports mixed-mode manufacturing processes. Is built with more than 25 years of manufacturing experience. Supports complex, global manufacturing and fabricating operations. Infor Industrial Manufacturing for fabricated metal manufacturers:Production line and processing machinery (e.g. injection moulds, assembly machines and robots) Material handling equipment (e.g. hand trucks, forklift trucks, conveyors, AGV's and cranes) Building services equipment (e.g. escalators, elevators, generators and air conditioning) Machine tools (such as a mill, lathe or sheet metal press)

tax depreciation for property use

An equipment inventory is a form that helps manufacturers keep track of the various pieces of equipment and machinery that are used in their production process. Equipment inventories typically include the description of the equipment, its current value, operating and maintenance costs, and depreciation information.

Question: Problem 10-6 Calculating Depreciation [LO1]A piece of newly purchased industrial equipment costs 0,000 and is classified as seven-year property under MACRS. The MACRS depreciation schedule is shown in Table 107. Calculate the annual depreciation allowances and end-of-the-year book values for this equipment.Note: Leave no .25 Trade Shows in USA related to Metal Working Industries; Exhibition Name Cycle Venue Date; IMTSInternational Machine Tool Trade Show. More than 82, 000 industrial decision-makers attend the International Manufacturing Technology Show (IMTS) to get ideas and find answers to their manufacturing problems: every 2 years: Chicago, IL McCormick .Key steel fabrication services that we perform for mining equipment companies include CAD design, plate bending, mechanical engineering, manufacturing of wear resistant components, plate rolling, plate forming, metal forming, cold forming, hot forming, steel plate fabrication, welding, heat treating, plate cutting and plate straightening.

National average salary: ,816 per year Primary duties: Industrial engineers are responsible for assessing operations in manufacturing environments and developing efficient manufacturing systems. In the metal fabrications industry, industrial engineers review the best way to develop metal products, including ways to acquire raw materials .

Custom Industrial Fabrication and Machining Specialists. . The employees at Pelham Machine & Tool and Pelham Industrial Manufacturing have numerous years of experience in precision machine work and manufacturing of special .The top five industry groups in attendance in 2022 included machine shops and contract manufacturers, metalworking machinery and equipment for fabrication, aerospace for aircraft, space and missiles, automotive and transportation, .Get the latest information on upcoming trade shows or contact us for information on our custom metal stamping, metal fabrication and laser cutting capabilities. 651-452-1441 Contact Us Request QuoteOther industries are following suit and finding a manufacturer they can contract with to help with some or all of their metal fabrication and manufacturing needs, like any of the following. Medical equipment ; Marine vessels and equipment ; Food processing equipment ; Energy industry equipment ; Structural steel projects in construction

Appropriate Maintenance equipment (Burn off ovens, welding, machining, tooling). Metal Forming and Fabrication Related Equipment Description. Conventional Metal Stamping Presses Currently, 45 to 800 ton capacity, with bed sizes to 144″. (Straight Side, OBI, Gap, Link Motion) Many with integrated coil straighteners and feeders. Depreciation Schedule for CNC Machinery What method do shops predominantly use to calculate depreciation for their machinery? Sort of random, but I am looking into maintenance position, and it would be nice to know if there are any industry norms regarding this task. . , Lasers,Engraving,woodworking,MetalWorking,Industrial Equipment .

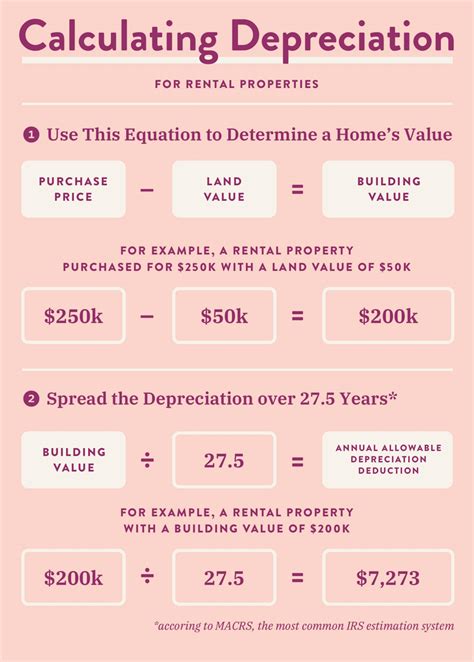

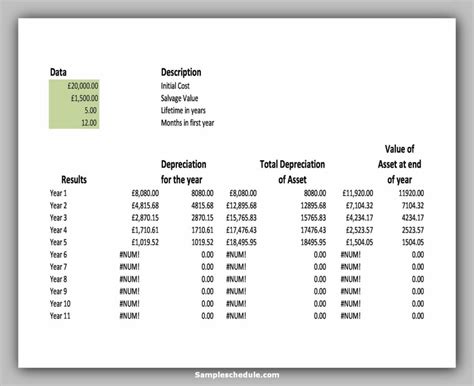

To calculate depreciation, you must also know the salvage value of a piece of equipment (the dollar amount for which equipment can be sold for scrap or parts at the end of its useful life). You can calculate depreciation with the following equation: (purchase cost – salvage value) / useful life = annual depreciation amount .

Graph and download economic data for Industrial Production: Manufacturing: Durable Goods: Fabricated Metal Product (NAICS = 332) (IPG332S) from Jan 1972 to Sep 2024 about fabrication, metals, IP, durable goods, production, goods, manufacturing, industry, indexes, and .A primer on what it takes to determine equipment manufacturing costs and some common costing methodologies used by contract manufacturers. . Sheet Metal Fabrication (23) Robust Quality Management Systems (22) . Industrial Equipment Manufacturing Companies (6) Product Prototyping (6) Value Engineering and Design (5) Events (4)

tax depreciation for personal use

SHEET METAL FABRICATION 1. INTRODUCTION: . Precision Sheet metal components and structures are having wide use in industrial and machinery manufacturing activities. . 7 Depreciation Rs. Lakhs 10.34 10.34 10.34 10.34 10.34 8 Net Profit Before Tax Rs. Lakhs -4.17 4.01 12.19 20.36 28.54

Plant and machinery procured and installed on or after September 1, 2002, in a water treatment system or a water supply project and put to use for the purpose of business of providing infrastructure facility under clause (i) of sub-section (4) of section 80-IA: 40% 8: 1. Wooden parts used in artificial silk manufacturing machinery: 40% 2.

$14.19

industrial manufacturing metal fabrication equipment depreciation schedule|tax depreciation for personal use