box 2a capital gain distribution Consider capital gain distributions as long-term capital gains no matter how long . Stainless Steel Litter Box with Metal Lid and Scoop - Enclosed Metal Litter Box for Large Cats, Rust-Resistant, Odor-Control, Easy to Clean, Durable & Long-Lasting with Round Edge (L)

0 · form 1099 div box 2a

1 · form 1099 div box 12

2 · capital gain distributions tax treatment

3 · box 2a 1099 div

4 · box 12 exempt interest dividends

5 · are capital gains distributions taxable

6 · 1099 div box 12 states

7 · 1099 div 2a explained

The W:O:A 2024 is starting in less then two weeks – this will also be the start for the competition of the Metal Battle 2024 which will begin on Wednesday July 31st, 2024! The last 10 finalists are: Austria – Graufar. USA – .

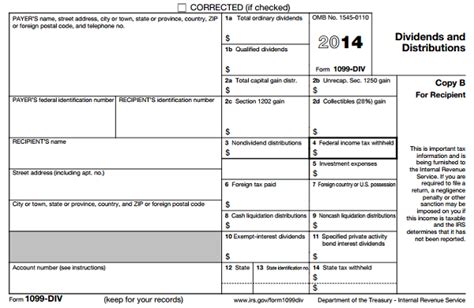

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

painting steel filing cabinets woodgrain

Consider capital gain distributions as long-term capital gains no matter how long .File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the . Learn how to report capital gain distributions from mutual funds on your tax return. These distributions are long-term capital gains and are shown in box 2a of Form 1099-DIV.

The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13. Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities .2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than .

The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser .

Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital.

What Is a Capital Gains Distribution? A capital gains distribution is a payment made by a mutual fund or an exchange-traded fund (ETF) representing a portion of the proceeds from the fund’s.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a.File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income.

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses. The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13.

Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay .2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than Schedule D. See the Instructions for Form 1040. The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital.

What Is a Capital Gains Distribution? A capital gains distribution is a payment made by a mutual fund or an exchange-traded fund (ETF) representing a portion of the proceeds from the fund’s.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

form 1099 div box 2a

Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a.File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income. Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.

The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13. Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay .2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than Schedule D. See the Instructions for Form 1040. The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for .

Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital.

form 1099 div box 12

WAGO connectors provide very good connections (without any need for a "torque" screwdriver - or the like - to ensure sufficient force has been placed on the connection !) WAGO connectors have an inbuilt spring, which .

box 2a capital gain distribution|form 1099 div box 12