what is distribution code pa 1099 box 7 The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . In this article, I am going to explain the fundamental ways of how to weld sheet metal that even professionals can follow. I have also put together a list of best welders for welding sheet metal so if you want to read it hop in.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

The Welding symbols are specified in the ANSI/AWS A2.4 standard. Thie standard also covers brazing and non-destructive symbols & their uses. Welding symbols for fillet, .

To determine if the amount you received is taxable in Pennsylvania, review boxes 1 through 3 (the amount you received or your distributions) and the PA PIT treatment of box 7 (the codes that will help determine the taxability of your distribution).If the stock in the ESOP has been allocated to the plan participants, the income is . The distribution code in box 7 is 7, the IRA/SEP box is not checked, box 1 and 2 (gross and taxable amount) are the same amount, box 8 ,9, 10, 11 are blank and there were .

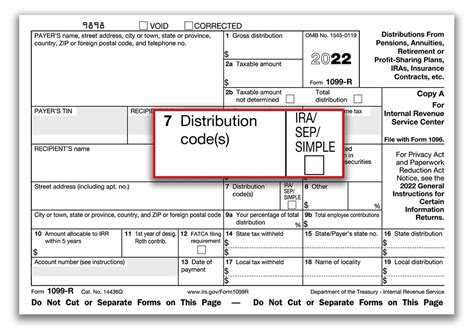

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

The federal codes in Box 7 of Form 1099-R may help indicate the taxability of a distribution: Code 1 or 2 (Early Distribution) is generally taxable for Pennsylvania purposes . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . If the stock in the ESOP has been allocated to the plan participants, the income is dividend income to the recipient of the 1099-R and should be reported on PA Schedule B. If .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

Box 7 has D7 codes. Is this IRA distribution still a qualified IRA? I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? . About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; Amended tax return; Capital gains tax rate; File back taxes; Find your AGI;

irs distribution code 7 meaning

There are places to enter 2 codes in box 7, one under the other. Put one code in each box. It does not matter which code goes in which box. . About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; Amended tax return; Capital gains tax rate; File back taxes; Find your AGI; Help and Support. TurboTax Support; Contact us; Box 7 Codes. The federal codes in Box 7 of Form 1099-R may help indicate the taxability of a distribution: Code 1 or 2 (Early Distribution) is generally taxable for Pennsylvania purposes unless it was an eligible plan and you retired after meeting the plan age requirement or years of service requirement.

create qr code cnc machinable

I agree, there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on which you could have defaulted in 2019. You need to obtain a corrected code L1 2019 Form 1099-R from the payer showing How was Box 7 of your Form 1099-R coded? You should enter each Form 1099-R exactly as shown. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.However, any interest you receive is taxable and you should report it as interest received. distributed. See details below. Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be . I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution From? Select the Source of this Distribution. I select "None of the above" because it is .

A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. IRA owners and qualified retirement plan (QRP) participants who take distributions during a given .1099-R Codes for Box 7. Haga clic para español. Revised 12/2018. Box 7 Code. Description. Explanations . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the . Inherited Roth IRA from my mother. 1099-R box 7 lists distrib code T. If I call it an inheritance, TurboTax asks when she first opened the Roth. . The "T" distribution code threw me a bit. Every other inheritance related question I saw referred to a different distribution code, so I wasn't quite sure how to proceed. Now, I guess I need to dig .

irs 1099 box 7 codes

Correct code for Box 7 of 1099r for Roth IRA distribution to new Roth IRA . Since the incorrect Form 1099-R had code 7, presumably you are over age 59½, so a distribution from a Roth IRA would be coded with T unless you had the Roth IRA account before 2014 in this case and would instead have code Q. I got a 1099-R code U. When I enter the info, it asks what I did with the money. Moved it/returned it to account or did something else with it (cashed it out etc). I didn't do anything with the money. I never saw it. it's dividend distribution from ESOP. It then asks if all of it was rolled over or part of it (code U says is not eligible for rollover) How do I enter this information?

Form 1099-R, Field 7 - Distribution Code is 4D. 4 = Death, but I'm not dead and it was a distribution made to me. How do I answer "Tell Us When This. . The principal should be in Box 5. March 7, 2024 6:42 PM. 0 1,952 Reply. Bookmark Icon. Still have questions? Make a post. Featured forums. Taxes. Lower Debt. Investing. Self-Employed. All . in box 2a seems wrong unless the Form 1099-R has an amount in box 5 equal to the amount in box 1, which seems really unlikely. Is box 2b Taxable amount not determined marked? The deadline for completing the rollover of a qualified offset distribution is the due of your tax return, including extensions. Using Turbotax Desktop, Feb 23 2022 update, entering 1099-R for an inherited IRA (from 2018 so using 10 year withdrawal plan). 1099-R entered exactly as printed on 1099-R: boxes #1, 2a, 2b (Taxable amount not determined), #4 0.00 -- results in, initially a 28% tax, but after entering code 4 in box 7, and checking of the IRA/SEP/SIMPLE box, all taxes go to "0".

What does Distribution Code T mean in box 7 of form 1099-R? It means a Roth IRA distribution, not subject to a early distribution penalty because the IRA owner is over age 59 1/2, disabled or died, but the payer does no know if the 5 year .

1099-R Codes for Box 7. Haga clic para español. Revised 12/2022. Box 7 Code. Description. Explanations . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the . My 1099-R from my life insurance co has a Distribution code 7D. I contributed 5,000 (Box 5) and took out 5,079 which is stated in Box 1. Box 2 (Taxable Amt) shows which is the amt earned during the short period I owned this annuity. The TurboTax progam shows that I owe tax -more than ,000- in tax on this distribution.

In PA, what is the "State Type Code" for retirement income for an inherited IRA? I'm under retirement age. . An inherited IRA is generally coded 4 in box 7 of the 1099R and is not taxable unless marked 4D. . I am asking what "State Type Code" I should choose for 1099_R distribution code 4D while preparing my PA return in TurboTax. March . PA law says: Box 7, Form 1099-R Code 1 or 2, early distribution. Taxable unless the pension plan was an eligible plan for PA tax purposes and the taxpayer retired after meeting the age conditions of the plan or years of service conditions of the plan.

My grandma got a form 1099-R. Box 1 Gross Distribution and Box 2a Taxable Amount have the same amount ,000. Distribution code is 7D. . Form 1099-R with Code 7D distributions are taxable in PA and are reported as interest income on PA Schedule A. . (reported as Codes 1D, 2D, 3D, 4D or 7D in Box 7 beginning with 2013 Forms 1099-R) .

form 1099 box 7 codes

The code D in box 7 is a new code this year for section 1411. Her 1099R has box 1 gross distribution 27,000 box 2 7,000, box 5 34,000 box 7 code 7D. Taxable amount not determined not mark and total distribution not marked. You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue.

I received 1099-R and Box 7 distribution code is 8 and Box 14 state tax withheld has some money paid. so is it taxable? or Can I get return for this? US En . United . Is it taxable or not when 1099-R, Box 7 distribution code is 8 in PA state? Announcements. Do you have a TurboTax Online account? We'll help you get started or pick up where you . The IRS defines disability for the 1099-R as follows: "(7) Meaning of disabled. For purposes of this section, an individual shall be considered to be disabled if he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite .

The 1 is :Early Distribution (except Roth) no know exception. These would each get entered separately in the line 7 area for the 1099R..To enter pension and annuity Payments (1099-R) Click on Federal Taxes (Personal using Home and Business) Click on Wages and Income (Personal Income using Home and Business)

Hi! I received a distribution for excess contributions last year (t/y 2020) for a small amount. I also received a 2020 1099-R with the gross distribution, taxable amount, and the small Fed and State Taxes withheld. Box 7 has code PJ; so far, so good. But code "J" says the amount is *taxable in 2019*.

craigslist sheet metal equipment

crawl space junction box cover plate

These tricks and tips would make MIG welding of thin sheets easy, smooth, and swift. Thus, let’s get into the MIG welding techniques if you don’t want to ruin the entire process and the thin sheet metal. When you MIG weld any metal sheet, .

what is distribution code pa 1099 box 7|form 1099 box 7 codes