distribution box 7 code t in tax act We're excited to announce our newest series of TurboTax Community Tax . Shop angles, brackets & braces and a variety of hardware products online at Lowes.com.Choose from our selection of electrical enclosures, including indoor enclosures, oil-resistant enclosures, and more. In stock and ready to ship.

0 · box 7 rollover codes

1 · box 7 r code

2 · box 7 ira contribution codes

3 · box 7 1099 r meaning

there is fabric glue that’s actually pretty cheap. super glue can work but it’ll make the fabric stiff. idk what type of Rhinestones you have but you can use iron on adhesive, it works with metal .

box 7 rollover codes

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax free) distribution .

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to .

We're excited to announce our newest series of TurboTax Community Tax .What are the tax deadline extensions for those affected by natural disasters? .

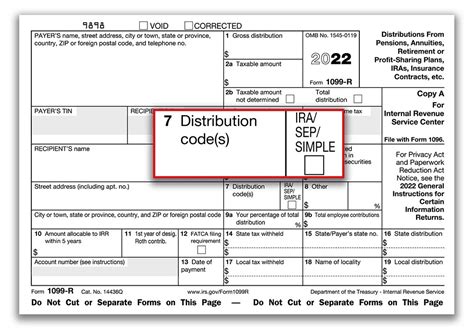

We would like to show you a description here but the site won’t allow us. T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth .These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

box 7 r code

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Code T - Roth IRA distribution, exception applies Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . This .For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early . Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a .

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .

T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. UThese distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Code T - Roth IRA distribution, exception applies Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, or; The participant died, or; The participant is disabled.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . This distribution is not subject to the 10% early distribution tax. This code is used only if the participant has not reached age 59 1/2 and the distribution is one of the .

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

box 7 ira contribution codes

Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a complete list of codes and their meanings, see Table 1 in the IRS Instructions for Forms 1099-R and 5498. Form RRB-1099 example. The RRB-1099 form is blue and looks something like . A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. UThese distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Code T - Roth IRA distribution, exception applies Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, or; The participant died, or; The participant is disabled. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . This distribution is not subject to the 10% early distribution tax. This code is used only if the participant has not reached age 59 1/2 and the distribution is one of the .

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

box 7 1099 r meaning

standard steel box sections quotes

$42.99

distribution box 7 code t in tax act|box 7 rollover codes