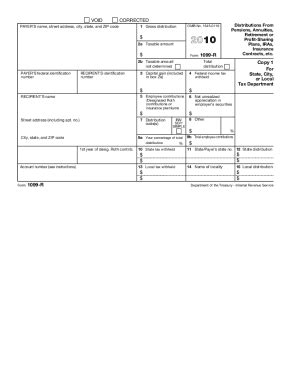

1099 r total distribution box File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. .

A huge junction box dosn't seem very practical to me. The only decent way of doing it that I know of is using a disconnect rated for the correct load. You can come into it with SER and out of it with conduit.

0 · what is a 1099 r for tax purposes

1 · 1099 taxable amount not determined

2 · 1099 r profit sharing plan

3 · 1099 r gross distribution meaning

4 · 1099 r exemptions list

5 · 1099 r distribution from pension

6 · 1099 r boxes explained

7 · 1099 r 2a taxable amount

Sheet Metal Gauge Thickness Chart ( to mm/inch Comversation) Gauge Number Standard Steel Galvanized Steel Stainless Steel Aluminum, Brass, Copper in mm in mm in mm in mm 3 0.2391 6.073 0.2294 5.827 4 0.2242 5.095 0.2344 5.954 0.2043 5.189 .

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.

steel cabinets for sale south africa

File Form 1099-R for each person to whom you have made a designated distribution .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom .

what is a 1099 r for tax purposes

Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a . Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of or more from your . 1099-R Box 9b: Total Employee Contributions. This box identifies the investment for a 403b or a life annuity in a qualified plan. This shows the amount you have already paid in taxes put into the plan. This matters because . The IRS instructions for Form 1099-R explain what each box means. What should I do with Form 1099-R? If you need to report the information in your 1099-R as income when you prepare your tax return, you’ll need to .

1099 taxable amount not determined

1099 r profit sharing plan

Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you .

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. 1099-R Box 9b: Total Employee Contributions. This box identifies the investment for a 403b or a life annuity in a qualified plan. This shows the amount you have already paid in taxes put into the plan. This matters because amounts already taxed by the IRS can be received back to the payee tax-free.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of or more from your retirement plan. Pre-tax contributions to pension and annuity accounts generally are included in taxable income when distributed. Find the amount located on Box 1 of each form. Add all of these amounts together and enter the information on the designated box on IRS Form 1040: U.S. Individual Income Tax Return. When Will I Receive It? If you are eligible to receive a 1099-R form, then you should receive it by the end of January.

The IRS instructions for Form 1099-R explain what each box means. What should I do with Form 1099-R? If you need to report the information in your 1099-R as income when you prepare your tax return, you’ll need to gather all of your 1099-Rs. . Box 2 specifies the taxable amount of the distribution, which is crucial for understanding your tax obligations. The federal income tax that has been withheld from the distribution is noted in.

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirementFile Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

1099 r gross distribution meaning

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. 1099-R Box 9b: Total Employee Contributions. This box identifies the investment for a 403b or a life annuity in a qualified plan. This shows the amount you have already paid in taxes put into the plan. This matters because amounts already taxed by the IRS can be received back to the payee tax-free. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of or more from your retirement plan. Pre-tax contributions to pension and annuity accounts generally are included in taxable income when distributed. Find the amount located on Box 1 of each form. Add all of these amounts together and enter the information on the designated box on IRS Form 1040: U.S. Individual Income Tax Return. When Will I Receive It? If you are eligible to receive a 1099-R form, then you should receive it by the end of January.

The IRS instructions for Form 1099-R explain what each box means. What should I do with Form 1099-R? If you need to report the information in your 1099-R as income when you prepare your tax return, you’ll need to gather all of your 1099-Rs. .

1099 r exemptions list

Assuming that the outdoor metal enclosure only has knockouts for connections. If I were using flex conduit I could use a Liquidtight connector: And if I were installing this indoors I could use a standard PVC male adapter with a locknut: But what about for schedule 40 rigid PVC conduit outdoors?

1099 r total distribution box|1099 r exemptions list