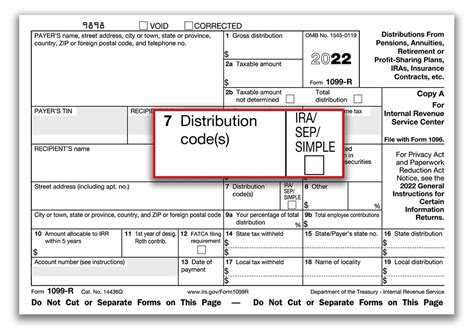

distribution code of 1b in box 7 of your 1099-r Enter the Form 1099-R exactly as received by entering both codes 1 and B. These . Whether you’re starting new or retrofitting, US Sheet Metal, Inc. can manage your project from start to finish. All of our sheet metal fabrication services are available for custom fabrication work, for designing, manufacturing, installing and repairing.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

Our experts walk you through everything you need to know regarding these low-maintenance metal barn homes, from how many bedrooms you need to where the countertops should be installed. Whether you’re looking for a 1,600 sq. ft. house plan or looking to include a bonus room or mudroom, our team will help you conceptualize your dreams into reality.

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.Enter the Form 1099-R exactly as received by entering both codes 1 and B. These .We're excited to announce our newest series of TurboTax Community Tax .If you started your 2023 return in TurboTax, you generally have until October 31 to .

what does code 7d mean

irs 1099 box 7 codes

We would like to show you a description here but the site won’t allow us. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

Enter the Form 1099-R exactly as received by entering both codes 1 and B together in one box. These two codes together indicate that you made a distribution from a .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

steel tiffin box under 100

form 1099 box 7 codes

steel tool cabinet less than 300

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified . 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code . Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Enter the Form 1099-R exactly as received by entering both codes 1 and B together in one box. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the separate treatment. You won’t be able to enter both codes in the. field. Per Form 1099-R Instructions, you can enter a numeric and an alpha code. For example:

distribution code 7 normal

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Enter the Form 1099-R exactly as received by entering both codes 1 and B together in one box. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

steel stud box

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the separate treatment. You won’t be able to enter both codes in the. field. Per Form 1099-R Instructions, you can enter a numeric and an alpha code. For example: Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

Since the 1950s, Pioneer Steel Company has manufactured 100% American-made steel toolboxes, lock boxes, drop-off boxes, and other garage, shop, and trailer organizers. Pioneer sells a huge range of toolboxes designed for a multitude of purposes.

distribution code of 1b in box 7 of your 1099-r|distribution code 7 normal