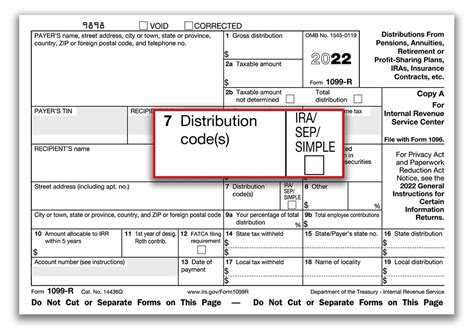

on a 1099-r what is a distribution code box 7 If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . Our certifications and standards cover junction and pull boxes, cabinets and cutout boxes, industrial control panel enclosures, IP and IK rated electrical enclosures, and enclosure accessories. Additionally, we can offer Type, IP or IK ratings .

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

The standard prototype and production machining tolerance at Protolabs is +/- 0.005 in. (0.13mm). This means any part feature’s location, width, length, thickness, or diameter will not deviate by more than this amount from nominal.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

sargent metal fabrication ames iowa

These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, .

irs distribution code 7 meaning

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. ** If a loan is treated as a deemed distribution, it is . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth .

irs 1099 box 7 codes

form 1099 box 7 codes

**If a loan is treated as a deemed distribution, it is reportable on Form 1099-R using the normal taxation rules of a retirement account. The distribution also may be subject to the 10% early distribution tax under Section 72(t).It is not eligible to be rolled over to an eligible retirement plan nor is it eligible for the 10-year tax option.

On my 1099-R, I have code G in box 7 AND an amount equal to the gross distribution (line 1) inserted in line 2a. The Payer assures me the distribution was made to a qualified plan. I strongly believe this is a non-taxable yet Turbo Tax is treating the data I entered with a full tax hit.

A common distribution code used in Box 7 of Form 1099-R is code 7, which indicates a normal distribution. This means that the distribution was made after the account holder reached the age of 59 and a half, and is .

This distribution will appear of Form 1040 lines 5a and 5b as a pension or annuity. Any Form 1099-R that is not from an a traditional IRA (IRA/SEP/SIMPLE box marked) or a Roth IRA (code J, T or Q in box 7) is reported as pension or annuity income. In this case, the code B indicates that this Roth account is not a Roth IRA. A Form 1099-R without a code in box 7 is not valid. If you are over age 59½, are you sure that box 7 does not have code 7? It's not uncommon for people to miss seeing a code 7 since it is the same as the box number. . If it was a regular distribution, go ahead and put code 7 in box 7. As dmertz points out, a 1099-R without a code in box 7 is . Nondisablity is just written on the form to by the agency providing the 1099-R. There is no code on a 1099-R for nondisabiltiy. You only enter the code in box 7a as is shown on your form. If the code is a 7 with the words Nondisabilty enter a 7 in box 7a. If the code is a 2 with the words Nondisabilty enter a 2 in box 7a. Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. By knowing what each code means, you can accurately report your distribution on your tax return. .

A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. IRA owners and qualified retirement plan (QRP) participants who take distributions during a given . The code D in the '1D' indicates that the distribution was from a nonqualified annuity. A distribution from a nonqualified annuity is not permitted to be rolled over. Any amount in box 2a is subject to tax and to an early-distribution penalty. If the distribution was actually from an IRA annuity, contact the payer to obtain a corrected Form 1099-R.

The code M1 indicates that your loan was paid off with an offset distribution from the retirement plan, effectively a distribution from the plan paid to you that was immediately turned around to pay off the loan. 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non .

Code E (Box 7 Form 1099R) – Distributions Under Employee Plans Compliance Resolution System. Submitted by STEVEN MERKEL . afraid if we do a distribution now from his IRA for the ,000- that the new custodian will issue a Form 1099R with a Code 1 (Early Distribution) for 2020 and then he’ll be taxed twice on the ,000 plus a 10% penalty .B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2). If box number 7 (distribution code) is blank on my 1099-R form what should I do? US En . United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX; Expert does your taxes . Is there an appropriate code somewhere near box 7 that's slightly misplaced? October 10, 2021 6:32 PM. 2 690 Reply. Bookmark Icon .

A regular distribution from a Roth IRA would be reported on Form 1099-R would be reported on Form 1099-R with either code J, T or Q depending on your age, and how long you had the Roth IRA. Since the incorrect Form 1099-R had code 7, presumably you are over age 59½, so a distribution from a Roth IRA would be coded with T unless you had the .

1099 r minimum reporting amount

What does Distribution Code T mean in box 7 of form 1099-R? It means a Roth IRA distribution, not subject to a early distribution penalty because the IRA owner is over age 59 1/2, disabled or died, but the payer does no know if the 5 year . If your 1099-R shows code J or T, TurboTax will assume that the entire distribution shown in Box 1 is an unqualified distribution. In general, the Payer of the distribution doesn't know whether the distribution is qualified or unqualified because the Payer doesn't know what other Roth IRA accounts you might have elsewhere and when you made . The 1 is :Early Distribution (except Roth) no know exception. These would each get entered separately in the line 7 area for the 1099R..To enter pension and annuity Payments (1099-R) Click on Federal Taxes (Personal using Home and Business) Click on Wages and Income (Personal Income using Home and Business) You are not permitted to change the code from what the payer provided on the Form 1099-R. Does the Form 1099-R provided to you by the payer have code F in box 7? I suspect not. If you had a distribution paid to charity as a QCD from an IRA, the Form 1099-R provided by the payer should have code 7 in box 7 and have the IRA/SEP/SIMPE box marked .

1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non .

I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not. Because you separated from service at 55, you are not penalized for not being 59 1/2. This meets the following 10% penalty exception: Qualified retirement plan distributions you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees). You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue.

Yes, the regular distribution of ,000 reported on the 2022 Form 1099-R code J will be entered on the 2022 tax return. Yes, the 2022 Form 1099-R with codes P and J for the 2021 excess contribution plus earnings will be entered on the 2021 tax return. @kojajt In the follow-up to entering the code 2B Form 1099-R, you must indicate that the distribution is NOT from a Roth IRA. TurboTax needlessly asks this question which serves only as an opportunity to make a mistake in answering since code B already explicitly indicates that the distribution from a Designated Roth Account in a qualified retirement plan, not from a Roth IRA. Codes 1 and M are separate codes in the same box 7 and each code must be selected separately in the two box-7 drop-down boxes of TurboTax's 1099-R form. The code 1 on each of the forms indicates that each of these distributions is subject to a 10% early-distribution penalty unless rolled over to another retirement account or you have a penalty . The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject to an early withdrawal penalty.

1099 r distribution codes 7d

Line power for a PROMHD11L preamplifier available at UHF aerial input. Power at all extension room outputs for infrared 'eyes'. On each output use a triplexed outlet plate ( PROOUT13 , PROOUT24RT , or PROOUT35RT ) to split the signals.

on a 1099-r what is a distribution code box 7|1099 r minimum reporting amount