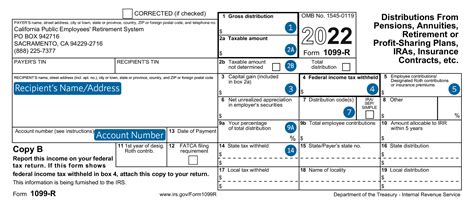

1099 r distribution box 5 Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From . Vigas Laminadas WF (Perfil H) Descripción: Perfiles “I” y “H”, de alas paralelas, según el standard americano WF (wide flange beams). Aplicaciones: Utilizados ampliamente en la industria de la construcción civil, estructuras metálicas, puentes, columnas, techos, entrepisos.Vigar Sheetmetal's are the leading sheet metal fabrication company in Perth, WA. Operating out of Malaga, our sheet metal fabricators specialise in long length, light gauge metal products. .

0 · total employee contributions 1099 r

1 · is 1099 r taxable

2 · gross distribution on 1099 r

3 · form 1099 r worksheet

4 · 1099 r taxable amount

5 · 1099 r income taxable

6 · 1099 r boxes explained

7 · 1099 r box 5 instructions

We specialize in vintage RV siding, vintage camper siding, and vintage trailer replacement siding. It doesn’t matter what scope of work needs to be done, we will go the extra mile and make sure you are 100% satisfied with how your RV, camper, or trailer looks.

total employee contributions 1099 r

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.File Form 1099-R for each person to whom you have made a designated distribution .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From .

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom .

is 1099 r taxable

gross distribution on 1099 r

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .The portion of your payment(s) that is not taxable is shown in Box 5 of the 1099-R. It is this amount that the IRS considers a return of your previously taxed contributions. The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true .

Box 5 on an IRS Form 1099-R is not a tax. Box 5. Generally, this shows the employee’s investment in the contract (after-tax contributions), if any, recovered tax free this .

Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year. What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of .1099-R Box 2: Gross Distribution. This box is significant because it identifies the taxable amount of a distribution that’s reported by the payer. The annuity or retirement plan determines the amount to include. As the payer, you’ll report .

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

custom printed electric heater boxes

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.The portion of your payment(s) that is not taxable is shown in Box 5 of the 1099-R. It is this amount that the IRS considers a return of your previously taxed contributions. The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true with FEHB, any post tax dollars count for medical expenses. Box 5 on an IRS Form 1099-R is not a tax. Box 5. Generally, this shows the employee’s investment in the contract (after-tax contributions), if any, recovered tax free this year; the portion that’s your basis in a designated Roth account; the part of.

Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year. What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of or more. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they .

1099-R Box 2: Gross Distribution. This box is significant because it identifies the taxable amount of a distribution that’s reported by the payer. The annuity or retirement plan determines the amount to include. As the payer, you’ll report this on line 4b or 5b on the 1040 Form.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

The portion of your payment(s) that is not taxable is shown in Box 5 of the 1099-R. It is this amount that the IRS considers a return of your previously taxed contributions. The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true with FEHB, any post tax dollars count for medical expenses.

Box 5 on an IRS Form 1099-R is not a tax. Box 5. Generally, this shows the employee’s investment in the contract (after-tax contributions), if any, recovered tax free this year; the portion that’s your basis in a designated Roth account; the part of. Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year. What is a 1099-R? A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll generally receive one for distributions of or more. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they .1099-R Box 2: Gross Distribution. This box is significant because it identifies the taxable amount of a distribution that’s reported by the payer. The annuity or retirement plan determines the amount to include. As the payer, you’ll report this on line 4b or 5b on the 1040 Form.

form 1099 r worksheet

Our Vcenter-P76/P106/P136 VMC machine is equipped with high feed spindle, roller guideways and crew chip removers. It would be a ideal choice for stability, rigid and performance machining. Seeking a VMC machine manufacturer? Victor Taichung is your first choice. Send us your inquiry!

1099 r distribution box 5|form 1099 r worksheet